are closed end funds riskier

In recent years it has gained popularity due to its features in the current low-interest-rate environment. Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds.

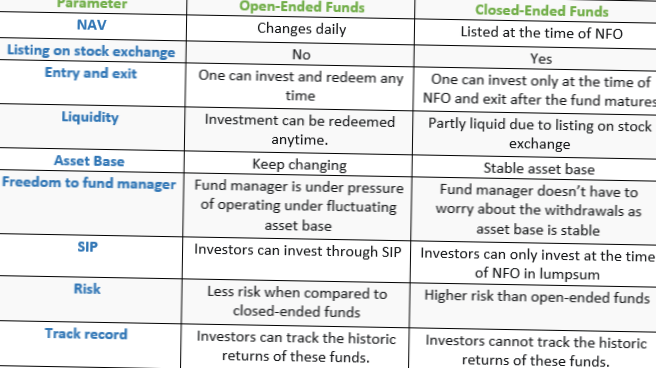

Understanding Closed End Vs Open End Funds What S The Difference

Some CEFs do not trade.

. CLO Closed-End Funds such as Eagle Point Credit or Oxford Lane Capital Corp. With the CEF market value largely driven by. 1516 and Barings Income Nt Ltd 2018-I.

Some traditional mutual funds also use leverage. Closed-end funds are considered a riskier choice because most use leverage. 10 Best Closed-End Funds.

By contrast closed-end funds can have management fees as high as 1 to 15. Closed-end funds may not be ideal for investors looking for riskier investments that offer bigger returns than safer ones. Too much debt makes the fund riskier.

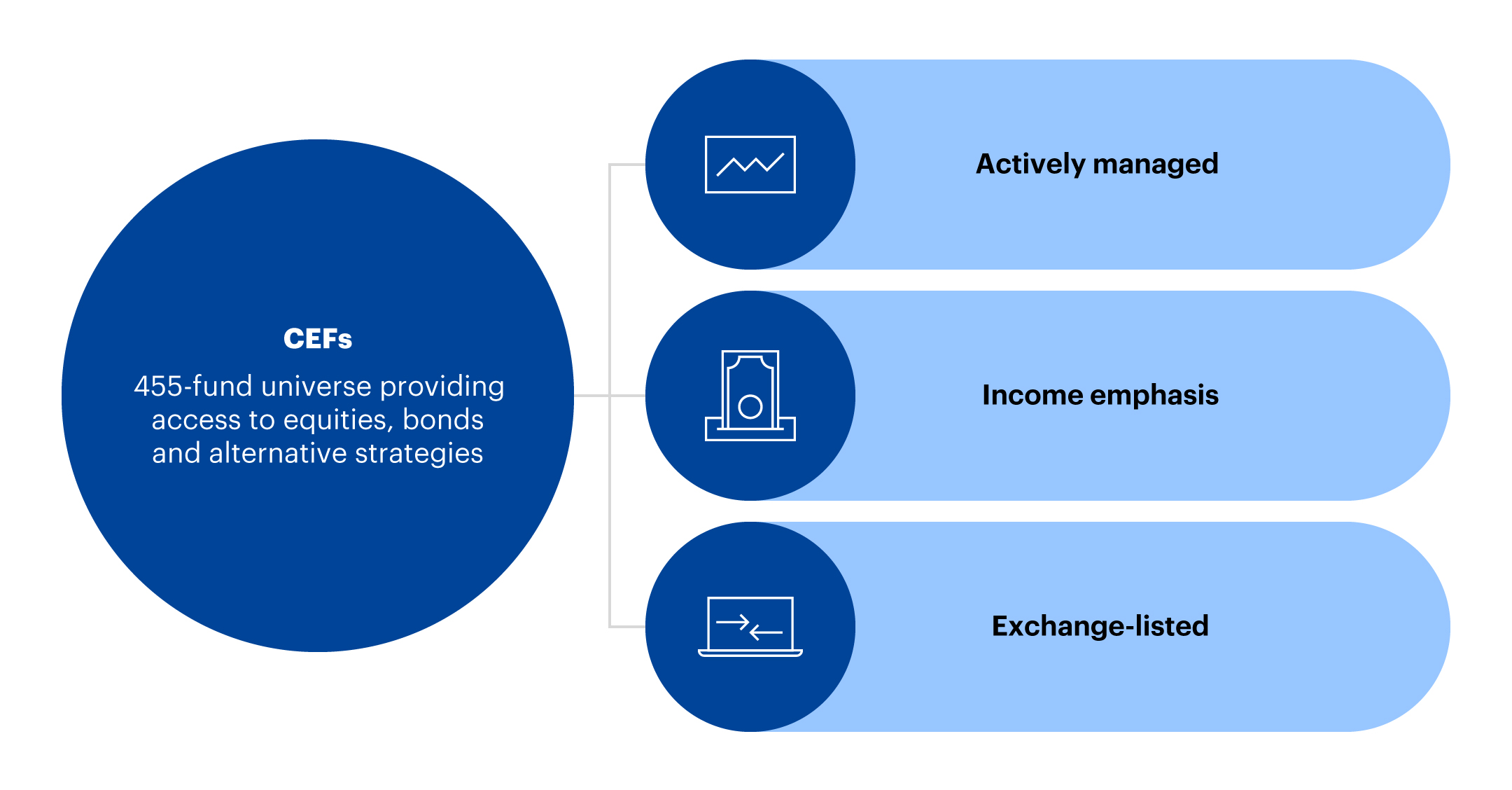

Using Eagle Point Credit as a prime example the most extensive holdings of this CLO fund are CIFC Funding 2015-II Ltd. Ad Build A Diversified Core Investment Portfolio. A closed-end fund CEF is a type of mutual fund where investors pool their money and a professional money management team oversees the portfolio by selecting the underlying stocks bonds and other securities.

The structure of closed-end funds allows them to pursue greater gains with higher risk. Start Your Investing Education. Closed-end funds by contrast are not continuously offered and have a fixed number of shares outstanding.

23 2011 751 AM ET ZF. Many CEFs but not all. Ad This Strategy Potentially Offers Considerable Yield Advantages.

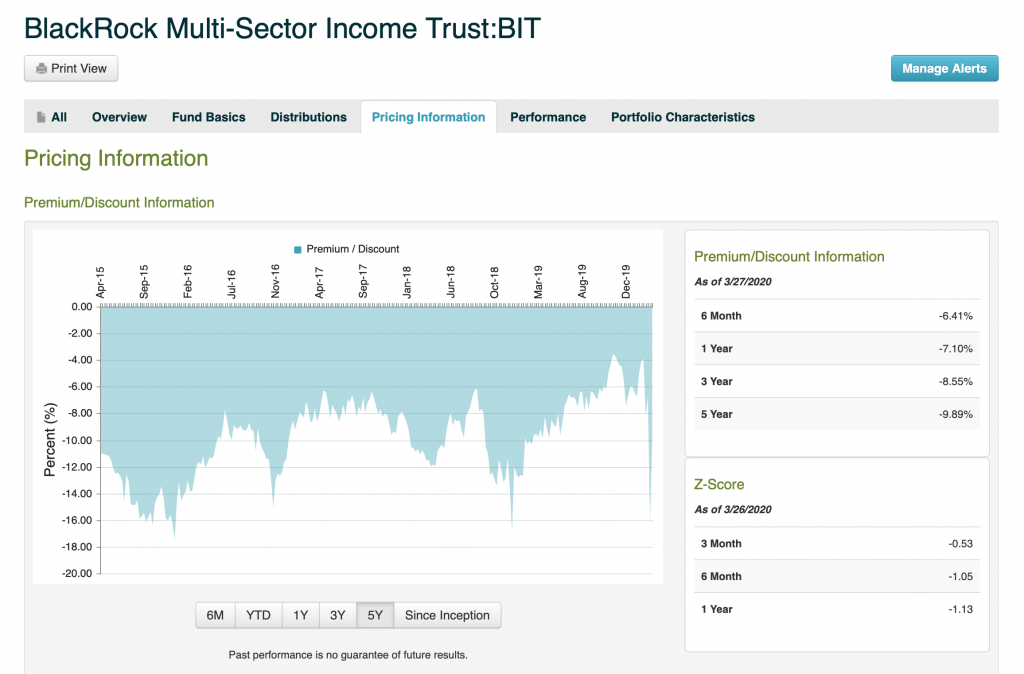

That is they invest using borrowed money in order to multiply their potential returns. A closed-end fund is a public indirect pooled investment vehicle. BlackRock believes that it is important for an investor to understand a Closed-end Funds overall investment objective.

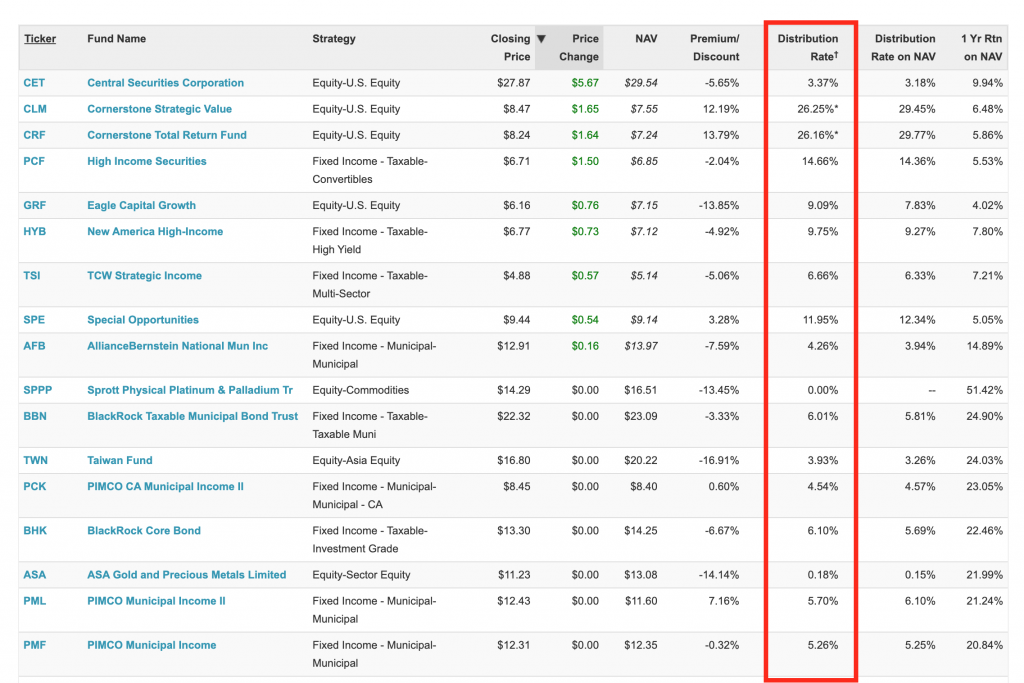

Like mutual funds closed-end funds can have a variety of objectives. Excellent Credit Good Credit Fair Credit Bad Credit No Credit. Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage.

They can make a good investment if you follow this rule. But be sure you weigh the risks. There is a one-time initial public offering IPO and with limited exceptions they are closed to new capital after the offering period hence closed.

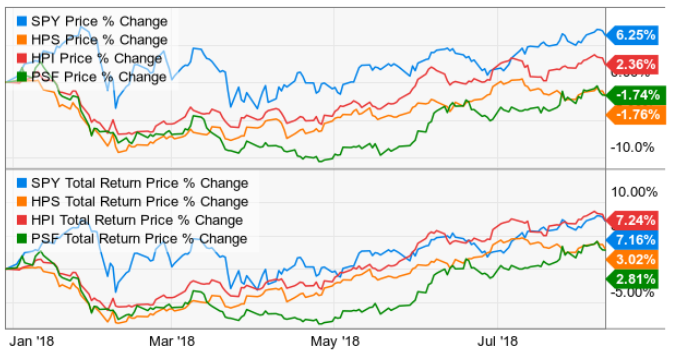

Closed-end funds trade on stock market exchanges. Anyone needing yield to survive is being pushed into the riskier assets that the market has to. The reason for.

Help Your Clients Keep More Of What They Earn With Tax Efficient Low-Cost ishares Core ETF. A closed-end fund is a type of investment company that pools investor contributions together to buy a mix of securities such as stocks and bonds. Always buy them at a discount.

A closed-end funds prospectus or annual report will outline if and how leverage will be used to meet the funds investment objectives. They average about 044 with some ETF index funds having whittled that down to pennies on the dollar. Saba Capital last year launched CEFS a closed-end fund ETF that is actively managed.

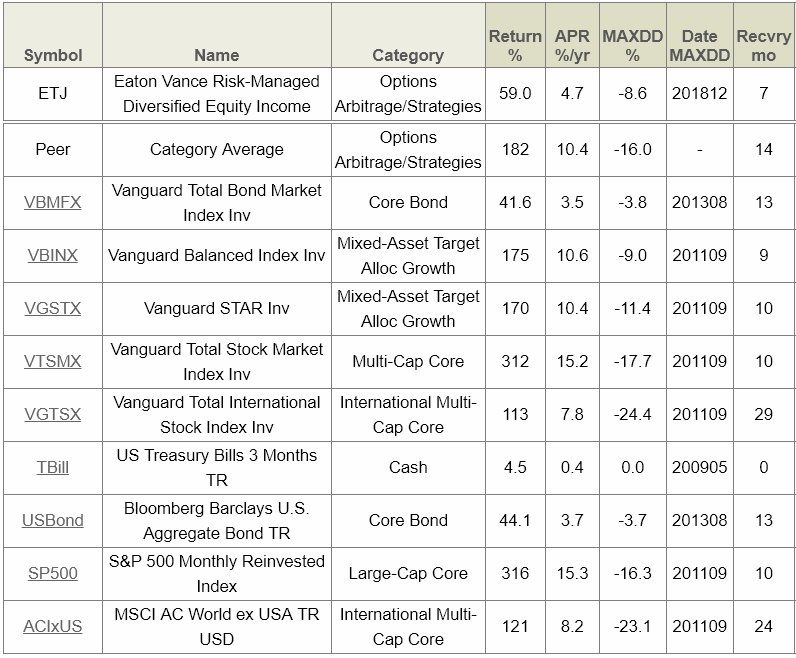

In short even CLO funds are too risky to comprise a large portion of anyones portfolio. The funds managers will make investment decisions in accordance with the stated investment objectives of the fund. A Primer On Risk for the Closed End Fund Investor.

This information is available in the Closed-end Funds prospectus and in shareholder reports. While small the 25 million fund has a distribution yield of 829 and a cumulative return of 1168. Closed End Funds.

Closed-end assets are riskier than open-end assets which is fine for those with a long time horizon. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market. Leverage makes a fund riskier.

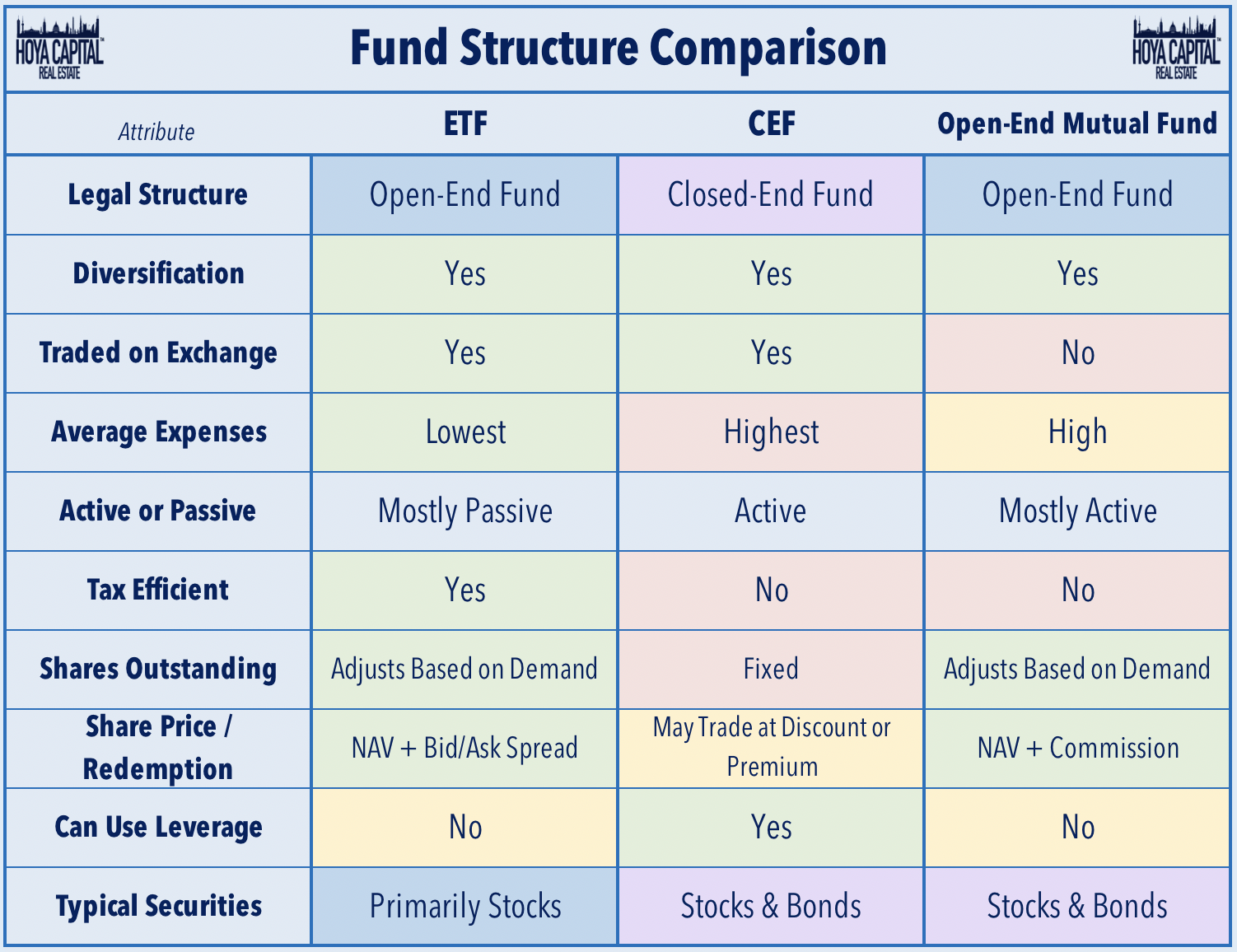

Closed-end funds are considered a riskier choice because most use leverage. You can learn more about the different types of. However closed-end funds have several important differences compared to the mutual.

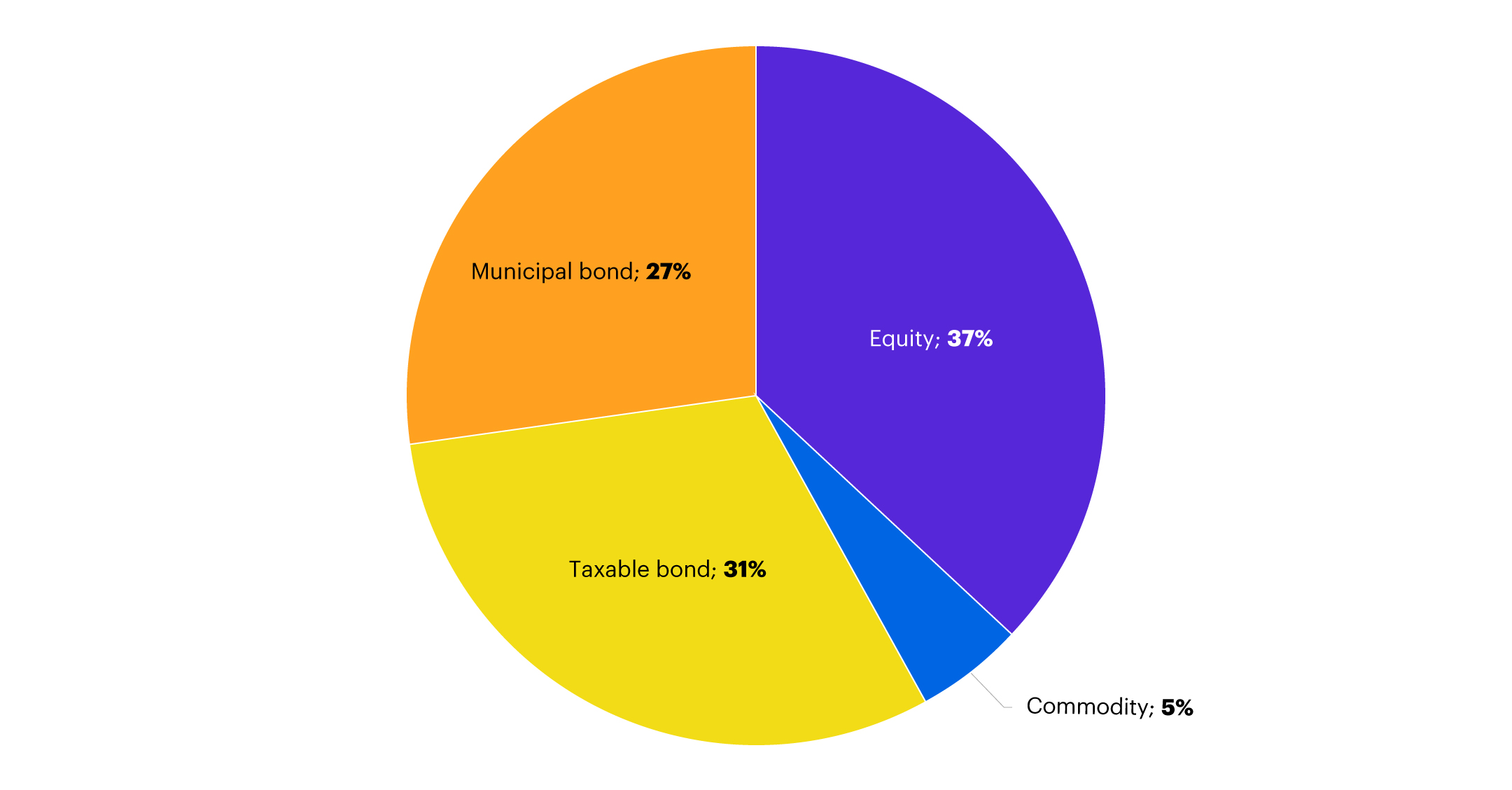

Understanding the investment objective will help investors determine whether the particular Closed-end Fund suits their. Just like open-ended funds closed-end. Its assets are actively managed by the funds portfolio managers and may be invested in equities bonds and other securities.

And Has Historically Provided Moderate To Low Correlation To Equity Fixed Income Markets. Learn About Stocks Bonds Futures and More. What Are Closed-End Funds.

Closed-end funds are one of two major kinds of mutual fund. The longer you plan on staying invested the longer you have to make up for declines should something go wrong.

Want Income Closed End Funds Offer Yield But Beware Of The Risks Stock News Stock Market Analysis Ibd

Managed Risk Portfolio Closed End Funds And Income Seeking Alpha

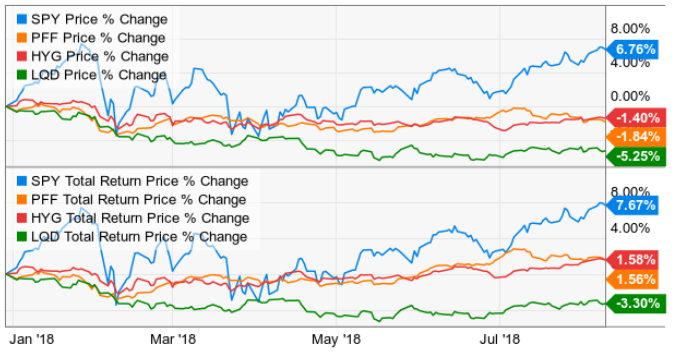

Preferred Stock Closed End Funds Reviewing The Category Seeking Alpha

Guide To Closed End Funds Money For The Rest Of Us

Guide To Closed End Funds Money For The Rest Of Us

Guide To Closed End Funds Money For The Rest Of Us

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Pros And Cons Of Closed End Funds

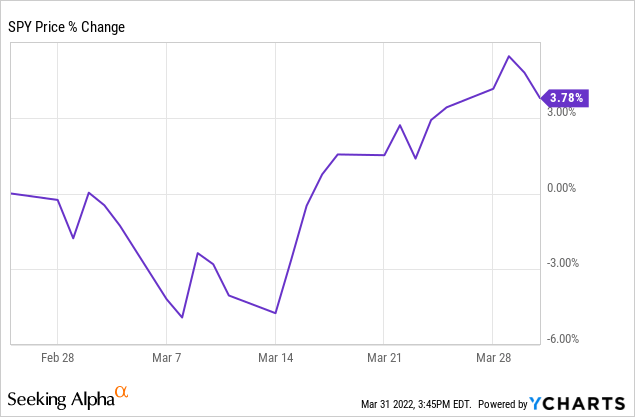

3 Closed End Funds Bought In March 2022 Seeking Alpha

Preferred Stock Closed End Funds Reviewing The Category Seeking Alpha

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

What Is A Closed End Fund And Should You Invest In One Nerdwallet

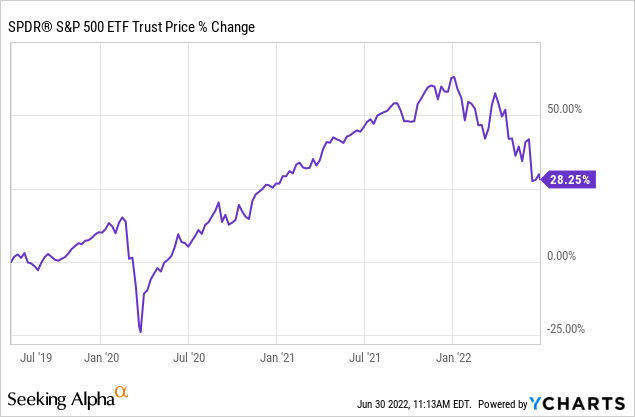

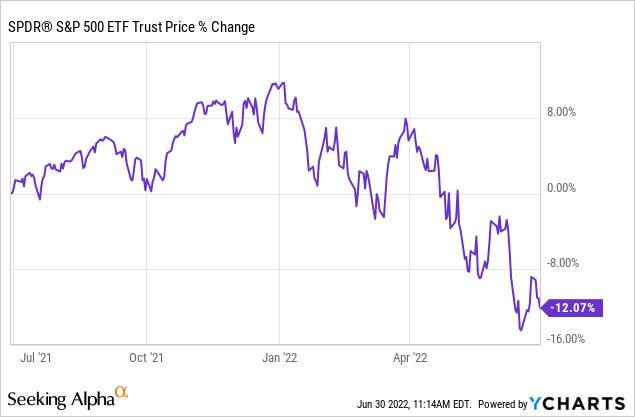

4 Closed End Fund Buys In The Month Of June 2022 Seeking Alpha

4 Closed End Fund Buys In The Month Of June 2022 Seeking Alpha

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

Difference Between Closed End Fund And Exchange Traded Fund Differbetween