san francisco gross receipts tax due date 2022

There are 27 types of organizations that can file for 501c status. Another tax form may start showing up for 2022.

Wordle Explained Everything You Need To Know About The Viral Word Game In 2022 Word Games Words New Words

For income tax purposes in California LLC members may deduct the gross receipts fee.

. Be sure you have the receipts or proof of the original purchase he adds. 501c is a section of the federal regulations which list the type of companies that can be exempt from paying taxes according to the Internal Revenue Service IRS. During 2021 we incurred approximately 572000 of additional water costs related to a property in Colorado which we do not expect to.

Annual indexing effective July 1. Taxpayers may continue to. So nothing changes with my current tax expense calculation.

According to the IRS most home sellers do not incur capital gains due to the 250000 and 500000 exclusion for single and. Since the due date is early in the year an LLC must plan ahead and make a reasonable estimate of its expected gross revenue for the year. For example say your gross income for the prior year was 50000 and it jumped up to 100000 for the current year.

2014 by ballot measure. Annual indexing effective July 1. 1607 to 1632 effective 7-1-2021.

But I need to account for my future deferred taxes that Im going to have. All LLCs must pay the required gross receipts fee on or before the 15th of the sixth month of the year. On 4 January 2022 the United States US Treasury Department published its third set of final regulations TD.

Annual increases based on the calendar year percentage change in the CPI-W for the San Francisco-Oakland-San Jose metropolitan area. You can make your quarterly tax payments based on the 75000 and you wont be penalized for it. 163j3 Taxpayers that are not tax shelters and have average annual gross receipts of 25 million or less the amount is subject to adjustment for inflation 26 million for 2019 and 2020 in the previous three years are exempt from IRC.

That regulates my rate. Many of these are not applicable to the average. The employer will remain eligible for the credit until such calendar quarter as their gross receipts equal 80 of the gross receipts for the same calendar quarter in 2019.

These types of companies are referred to as 501cs. Im still expecting to see 21 of tax due on my tax return. 1607 to 1632 effective 7-1-2021.

The CAA 2021 also addresses the interplay for businesses that intend to claim both the ERC and the research and development. So my total tax expense in year one is 5250 over my pre-tax book income of 250. If you decide to sell your house to simplify life lock in gains downsize or relocate for a job this article will help you minimize your capital gains tax bill.

References in these instructions are to the Internal Revenue Code IRC as of January 1 2015 and the California Revenue and Taxation Code RTC. Qualifying Wages The wages that can be used to calculate the tax credit differ based on whether the employer has over or under 100 employees. The Consolidated Appropriations Act 2021 CAA 2021 a coronavirus relief package enacted on December 27 2020 contains a number of provisions to assist businesses and individuals that have suffered economically from the coronavirus pandemic.

Small business taxpayer exemption IRC. Filing_upsell_block Finding out how much penalty. This increase was primarily due to additional water costs incurred on certain properties and an increase in property tax expense due to certain recent acquisitions and changes in certain lease structures.

You may even be able to pay no capital gains tax after selling your house for big bucks. But you will need to pay tax for the extra 25000 as a lump sum on April 15. 9959 the Final Regulations on foreign tax credits since the enactment of the Tax Cuts and Jobs Act TCJAThe Final Regulations adopt proposed regulations that were published on 12 November 2020 the Proposed Regulations with some modifications.

Net Operating Loss Suspension For taxable years beginning on or after January 1 2020 and before January 1 2023 California has suspended the net operating loss NOL carryover deduction.

State Tax Rates 2022 What Numbers Determine Your Contributions Marca

Tax Filing Season 2022 What To Do Before January 24 Marca

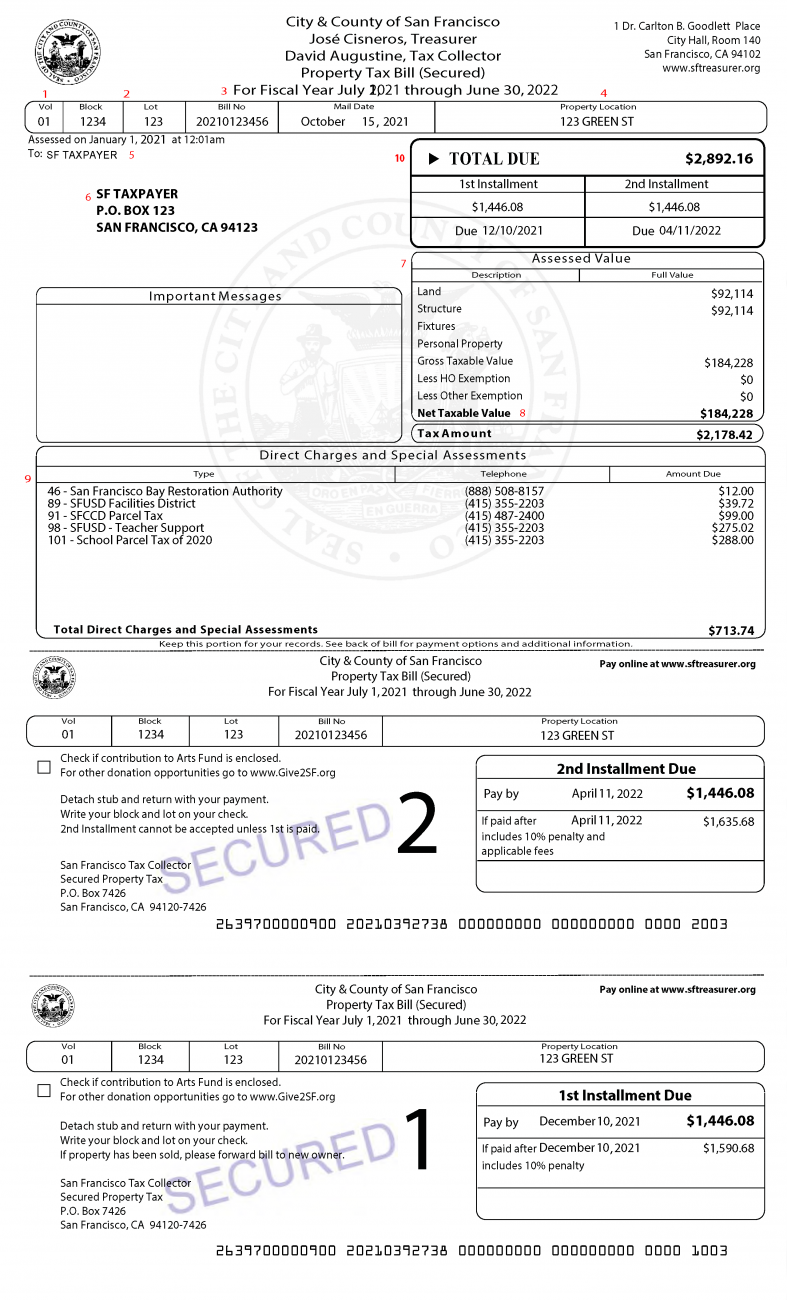

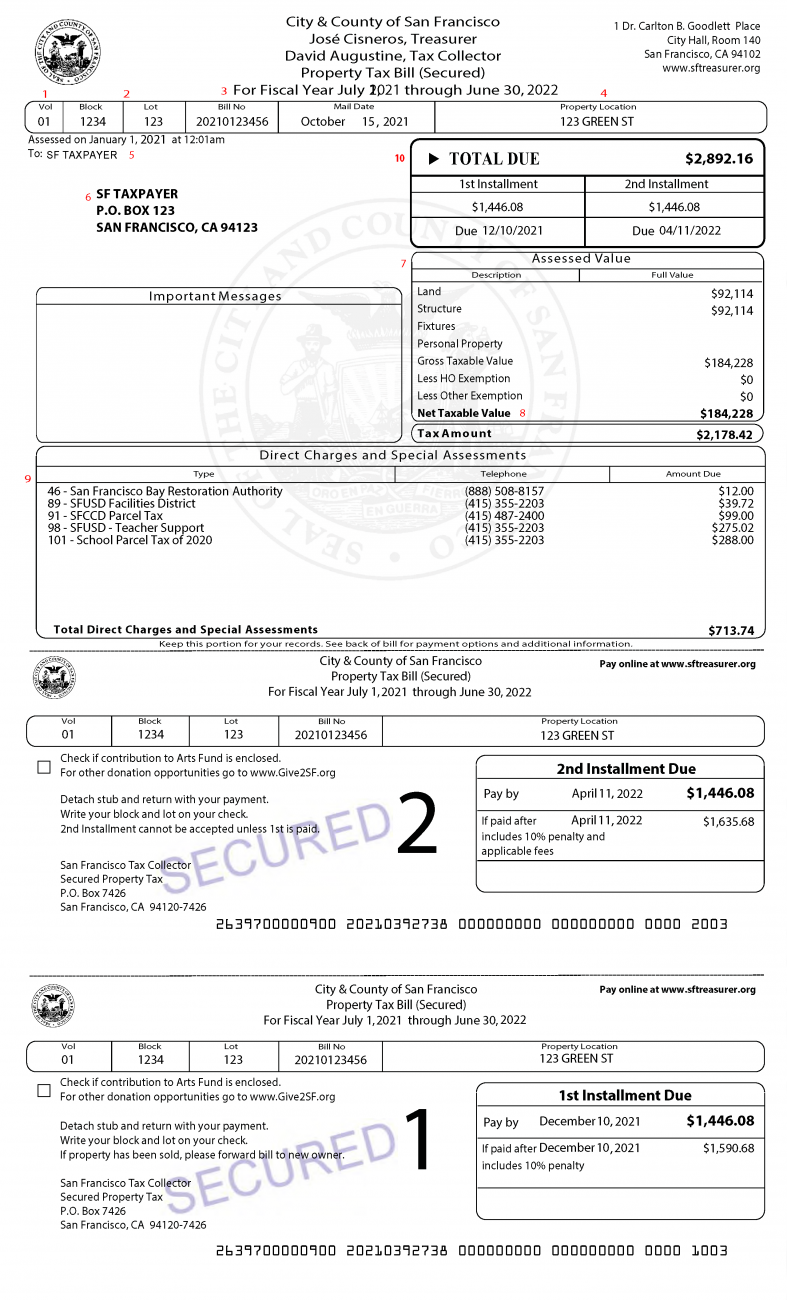

Secured Property Taxes Treasurer Tax Collector

Expansion On Excise Tax Excisetax Cybersecurity Businesssetup Taxation Dubai Business Business Success Business

Car Driver Salary Receipt Template Format Excel Template Receipt Template Excel Templates Project Management Templates

Employers Must Set Compensation Policies For Remote Workers Taking Into Account Federal And State Tax Laws And State In 2022 Remote Workers Benefit Program Remote Work

Secured Property Taxes Treasurer Tax Collector

Tax Day Irs Pushes 2020 Tax Filing And Payment Due Date From April 15 2021 To May 17 2021 Abc7 San Francisco

Irs Tax Refund 2022 How To Calculate Your Refunds For This Year Marca